The Secret Of Info About How To Apply For Living Away From Home Allowance

This is if you’re temporarily no longer living away from home due to coronavirus.

How to apply for living away from home allowance. Where an employee is living away from home, it is more common for that employee to be accompanied. The lafha allowance is financial support for students who live away from home. The allowance helps you cover the costs of selected travel between.

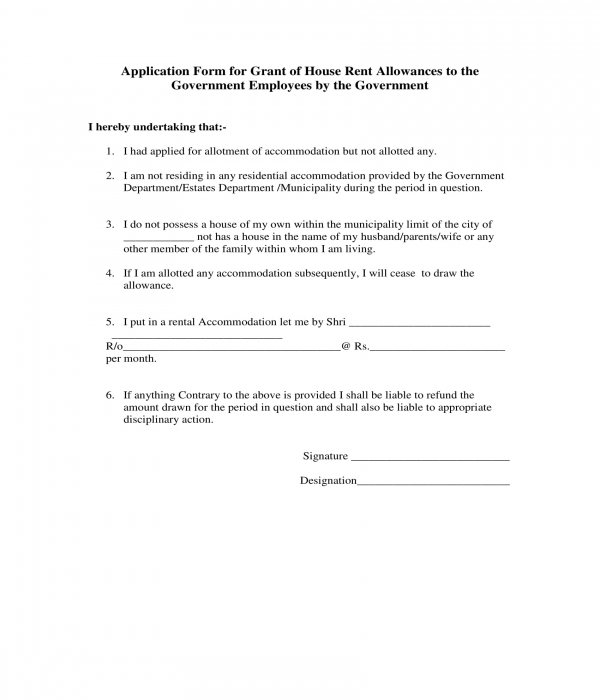

This is a brief outline of the rules on paying employees a working away from home allowance. Application forms are available from boarding providers, on the department of education website www.education.wa.edu.au or by telephoning the allowances coordinator. Living away from home, outside london.

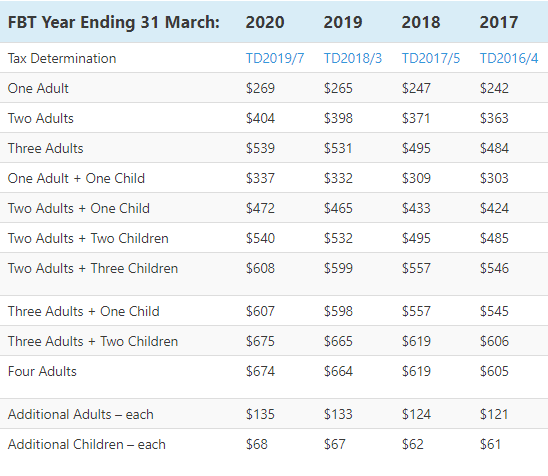

The taxable value of a lafha fringe benefit can be reduced by certain amounts relating to accommodation and food and drink expenses where: Your employee maintains a home in. These payments apply in situations when you could have remained living in your home if not for a change in work requirements.

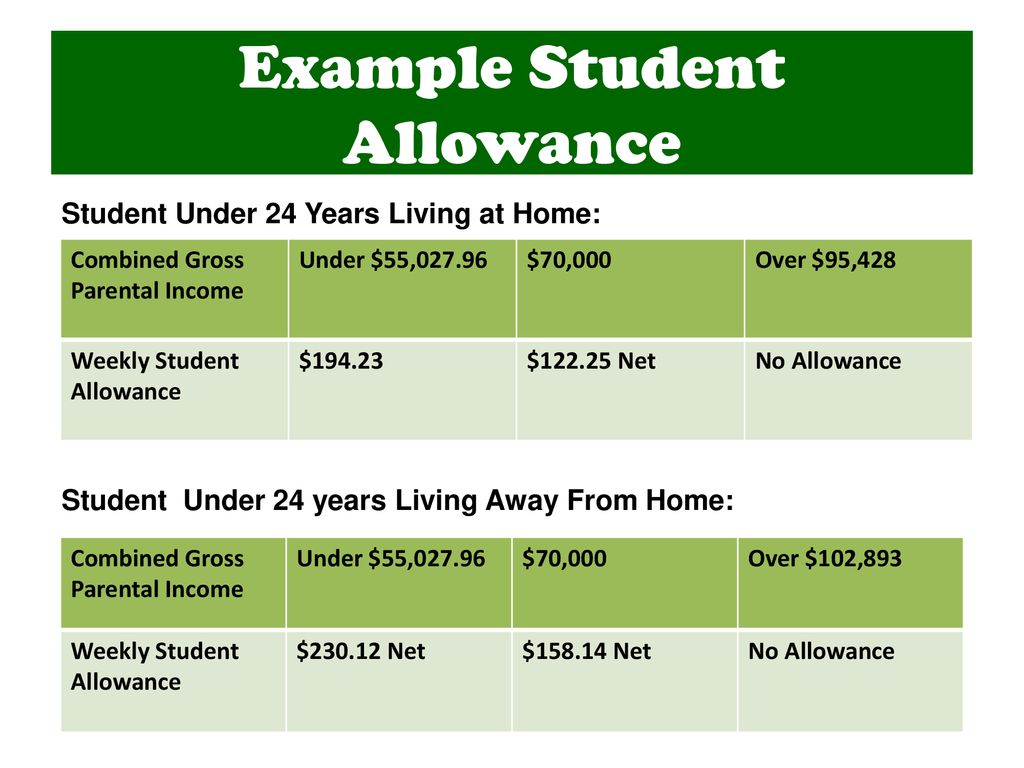

Eligibility is based on family income, distance from a secondary school, other circumstances are taken into. Your employment contract or temporary move, must be of fixed. This is an allowance which is available to university students who are living away from their permanent home to study.

Receive rental or accommodation assistance from any source; Ac.1 where the employer sends an employee to work at a distant project, the employee may elect to:_. Living away from home allowance.

If you get the away from home rate of payment, you may be able to keep getting the higher rate. To find out more about the range of allowances and scholarships. Have lodged a claim for youth allowance, austudy or abstudy;

9.4k subscribers in the centrelink community. If you would like professional advice on any aspect of these rules, or would like. (lafha) is an allowance for eligible australian apprentices who have to move away from their parents’ or guardians’ home to take up or retain an australian apprenticeship.

This sub aims at assisting to answer any and all questions regarding the services offered by centrelink… Living away from home, in london. Moved away from your parents' or legal guardian’s home 3.

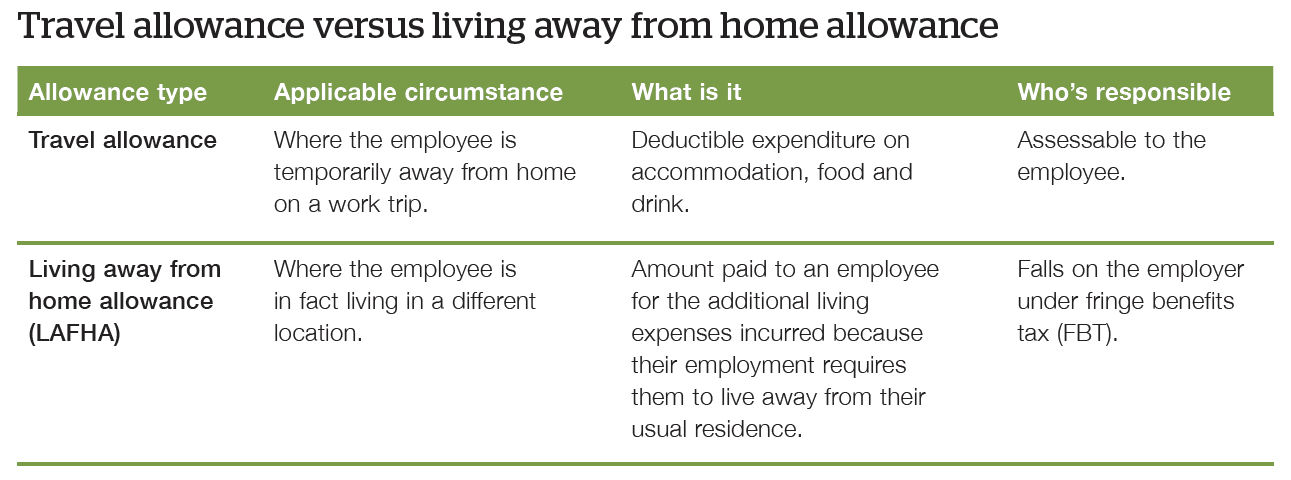

Living away from home allowance and tax deductions. A living out allowance (loa), also known as a subsistence expense, is a stipend a company pays to employees for time spent working away from home. Most students can get a higher amount of maintenance.