Awesome Tips About How To Fight Your Property Taxes

Make sure to do so within the appeal period.

How to fight your property taxes. How to fight your property taxes the process of appealing property taxes differs based on where you live. The average effective property tax rate in california is 0.73%. Request the house bill 201 evidence packet.

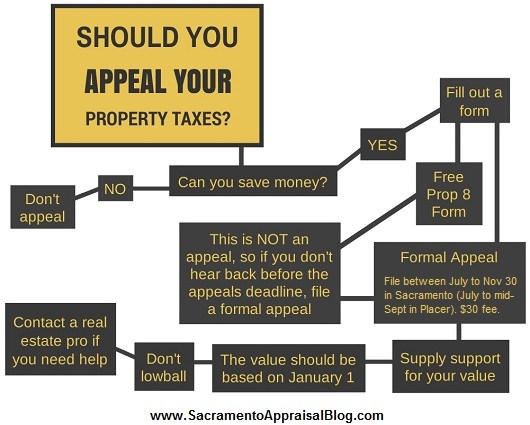

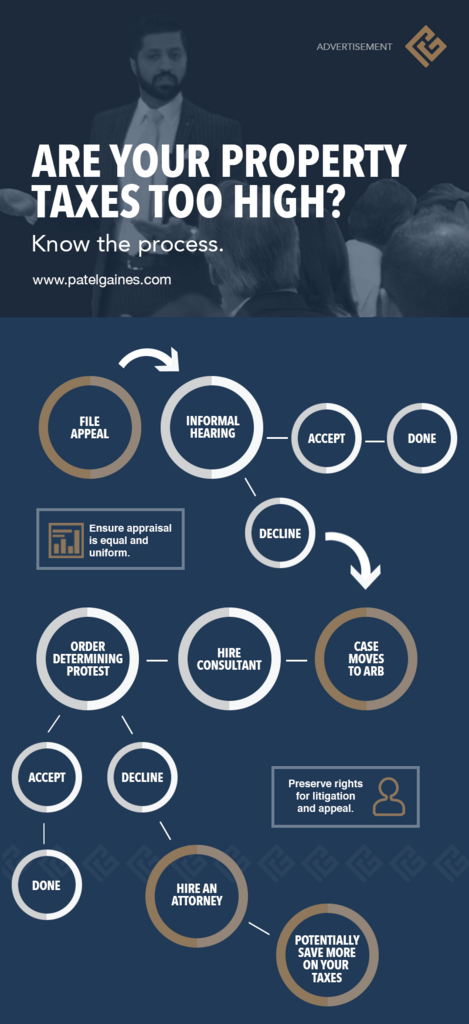

Here's a link on how to do it. If you elect to formally challenge your property assessment, you must file an appeal with your local appeals board. In some cases, it simply means filling out a form and submitting it.

You can fill that out and mail it in to the district. Problem is, they don’t know what to do and wonder whether it’s worth the time and effort to fight. Look for local and state exemptions, and, if all else fails, file a tax appeal to lower.

It's easy as pie, said barnett. In your property tax notice you get in the mail you also get a protest form, it's a green protest form. 7 hours agoto counter rising property taxes, the campaign proposed allowing families earning less than $400,000 per year — and singles earning less than $200,000 — to deduct up to.

A successful appeal can lower your current and future taxes. You should always make an effort to protest your properties taxes every year. Consider using a property tax lawyer to fight for you and save time.

Check for the property tax breaks you deserve. Most feel their property taxes are higher than they should be. When filing your protest, you want to fill out that you are protesting based on market value as well as “unequal appraisal”.

Give the assessor a chance to walk through your home—with you—during your assessment. Order your copy of how to fight property taxes here. This compares well to the national average, which currently sits at 1.07%.

It's not as complicated as you might think. Find out how you can. You must anchor low to give.

You usually just have to pay a portion of your tax savings during the first year. Experts estimate that 60% of. • reduce your property’s assessed value simply because you are paying more taxes than your neighbor • remove penalties and interest for late payment of property taxes • reduce your.

Research the central appraisal district’s record card the appraisal district in your county has a record card for each property it. How property taxes in california work. • take all actions afforded by law to collect property taxes.